Tuesday, September 18, 2007

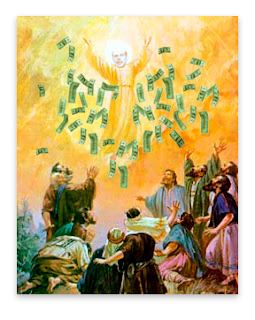

Miracles

Wall Street reacted with glee today at Ben Bernanke's "Miracle of the 50 Basis Points Interest Rate Cut With Maybe More To Come."

Wall Street reacted with glee today at Ben Bernanke's "Miracle of the 50 Basis Points Interest Rate Cut With Maybe More To Come."Most of the shills on CNBC loved the move too and cooed for more cuts in the future.

City National Bank chief investment officer Richard Weiss says the markets today got “everything they wanted and more.”

Jon Evans, chief executive of Atlantic Central Bankers Bank, said “God bless the greatest central bank in the world. This is great news for the economy and the consumer.”

I decided to listen to The Move rather than watch Jim Cramer's show tonight, but I'm sure he's issuing lots of "boo-yah's!!!" in celebration of today's cuts.

But not everybody is gleeful:

Sept. 18 (Bloomberg) -- Interest rate cuts by Federal Reserve Chairman Ben S. Bernanke will spur inflation, cause the U.S. dollar to collapse and push the world's largest economy into recession, investors Jim Rogers and Marc Faber said.

``Every time the Fed turns around to save its friends on Wall Street, it makes the situation worse,'' Rogers said in an interview from Shanghai. ``If Bernanke starts running those printing presses even faster than he's doing already, yes we are going to have a serious recession. The dollar's going to collapse, the bond market's going to collapse. There's going to be a lot of problems in the U.S.''

Faber and Rogers, who both spoke today before the Fed decision on rates, said the central bank should raise borrowing costs to quell inflation and support the U.S. currency.

``The cause of the problems we have today, they are due to artificially low interest rates, expansionary monetary policies and extremely rapid credit growth that was fueled by a totally irresponsible Fed,'' said Faber, who oversees about $300 million as managing director of Hong Kong-based investment advisory company Marc Faber Ltd. ``It's suicidal to cut interest rates.''

I guess Faber and Rogers aren't believers in the "Miracle of the 50 Basis Points Interest Rate Cut With Maybe More To Come."

Heathens.